Revised taxes effective Monday, July 1, in the City of Myrtle Beach

Pursuant to the South Carolina Circuit Court Order of June 21, 2019, the City of Myrtle Beach will begin charging its Local Accommodations Tax, Hospitality Tax and Hospitality Fee as outlined in the chart below on Monday, July 1, 2019. These revised taxes and fees will be reportable to the city by merchants/retailers no later than August 20, 2019, for July sales activity.

We recognize that this is relatively short notice for retailers and merchants to adjust cash registers and point-of-sale devices. Again, retailers and merchants have until August 20 to make payments for July sales activity. Prior to July 1, merchants and retailers should continue to pay the 1.0% City Hospitality Fee and the .05% Accommodations Tax.

A copy of the Court Order is available at https://www.cityofmyrtlebeach.com/2019-06-21%20Order%20re%20Preliminary%20Injunctions.pdf. Of interest to retailers and merchants, the order also addresses the Uniform Service Charge (“1.5% Hospitality Fee”) previously collected by Horry County within the city’s corporate limits.

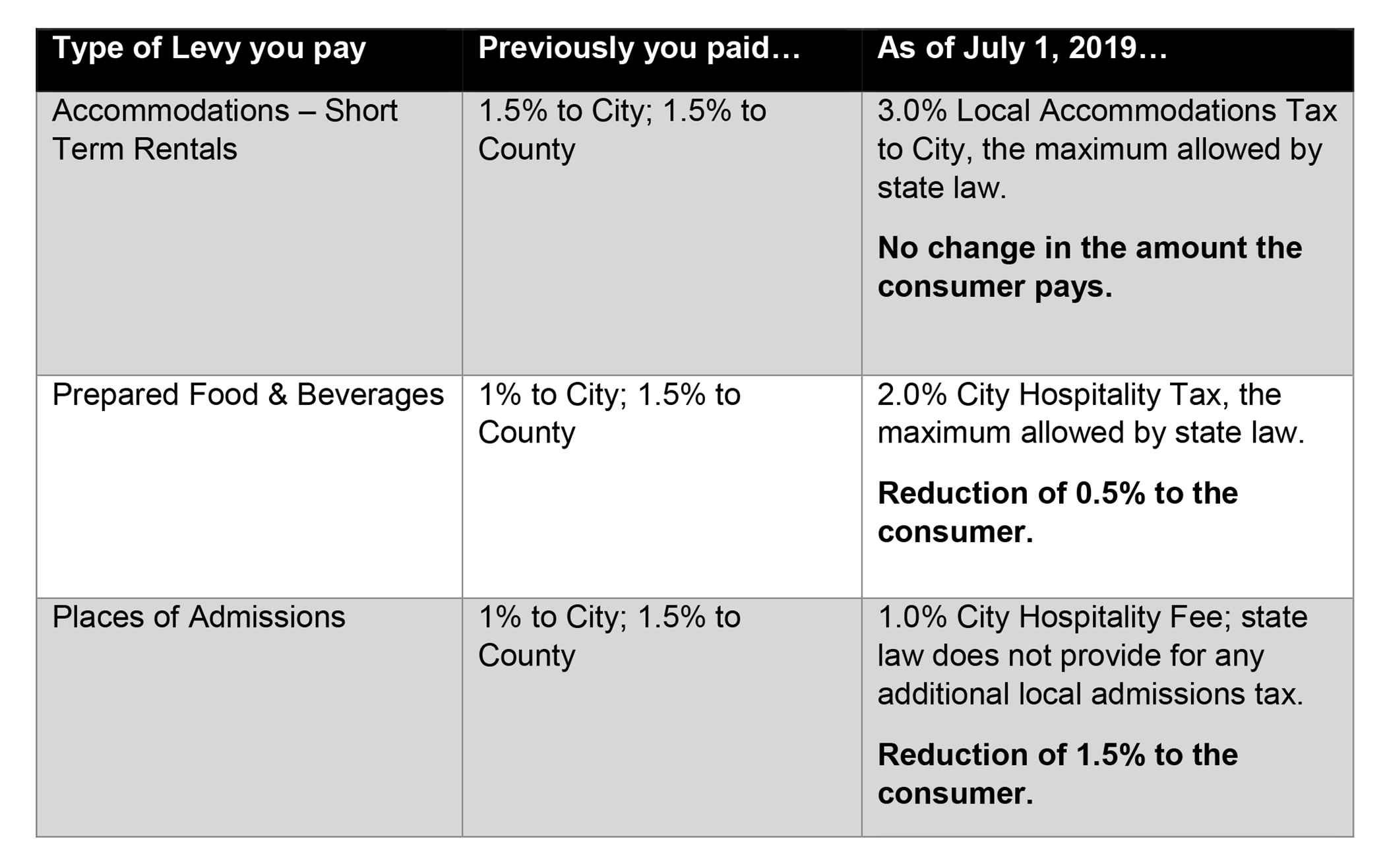

The changes in the city’s rates have been adopted by ordinance under authority of Title 6, Chapter 1, Articles 5 and 7, of the South Carolina Code of Laws. The following table shows the amounts that merchants/retailers currently collect and pay, versus amounts they will collect and pay as of Monday, July 1, 2019. Note that rates will decrease in two instances.